Exclusive lifestyle and reward benefits for the guardians of our nation

1% waiver (up to ₹250/month)

10 reward points per ₹100 on departmental stores & movies; 2 points per ₹100 on other spends

6-month FITPASS Pro + 500 reward points on ₹5,000 spends

Enter your details to get started

| Benefit | Details |

|---|---|

| Exclusive Online Rewards | Up to 10 reward points per ₹100 on select categories |

| Welcome Gift | 6-month FITPASS Pro + 500 reward points on ₹5,000 spends. |

| Milestone Benefits | 12-month Amazon Prime membership on ₹1 lakh spends within 90 days |

| Lounge Access | 8 complimentary domestic lounge visits per year (2 per quarter) |

| Fuel Surcharge Waiver | 1% waiver, up to ₹250/month |

| Attribute | Classification |

|---|---|

| Issuer / Provider | Bank of Baroda |

| Bank / Non-bank | Bank-affiliated |

| Category | Travel, shopping, membership |

| Type of Card | Lifestyle & Rewards Credit Card |

| Free or Paid | Free – No joining or annual charges |

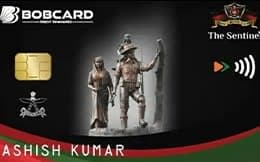

The ASSAM RIFLES the Sentinel Credit Card is a dedicated offering for the brave personnel and veterans of the Assam Rifles, designed to combine lifestyle privileges, fitness perks, and financial rewards. It is ideal for members who want a no-fee credit card that offers a mix of fitness, shopping, and travel advantages.

Zero annual and joining fee

Complimentary FITPASS Pro membership worth ₹15,000

Exclusive rewards on departmental stores, entertainment, and online spends

Lounge access and travel benefits for frequent flyers

10 reward points per ₹100 on departmental stores and movie spends (capped at 1,000 points/month)

2 reward points per ₹100 on all other categories (including UPI spends)

1 reward point = ₹0.25

500 points on spending ₹5,000 within 60 days of issuance

12-month Amazon Prime membership on ₹1 lakh spends within 90 days

8 domestic lounge visits per year (subject to ₹20,000 quarterly spends)

Complimentary concierge service via RuPay network

1% fuel surcharge waiver up to ₹250/month

Personal accidental death cover of ₹20 lakh

Note: Fuel, wallet loading, and select MCC transactions are excluded from reward eligibility.

Disclaimer: The card features, benefits, application process, and other details mentioned above are accurate at the time of writing but may change without prior notice.

| Fee Type | Amount | Details |

|---|---|---|

| Joining Fee | Nil | No joining fee for new applicants |

| Annual Fee | Nil | Lifetime free card with no annual renewal charges. |

| Finance Charges | 3.49% per month (41.88% p.a.) | Applied on outstanding balances if dues are unpaid. |

| Fuel Surcharge | 1% (up to ₹250/month) | Valid on fuel spends between ₹400 and ₹5,000 at all fuel stations. |

| Criteria | Details |

|---|---|

Eligible Applicants | Exclusively for serving and retired Assam Rifles personnel |

Primary Cardholder Age | 18 to 70 years |

Add-on Cardholder Age | 18 years & above |

Occupation | Serving or retired Assam Rifles personnel |

Nationality | Indian residents only |

| Document Type | Details |

|---|---|

| Photo | Recent passport-size photograph with clear/white background |

| Identity Proof | Assam Rifles ID card, PAN Card |

| Address Proof | Aadhaar Card, Voter ID, Passport, Driving Licence, Job Card (MNREGA) |

| Income Proof | Service Certificate or latest salary slip (for serving personnel), PPO for veterans |

Click on Apply Now: Hit the 'Apply Now' button to start your application.

Fill in Your Detail: Enter your personal, contact, and financial details in the application form.

Upload Required Documents: Upload your PAN Card, Aadhaar/Address Proof, and Income Proof.

Submit Your Application: Review all the details and click Submit.

Approval & Card Delivery: Once approved, your Assam Rifles Credit Card will be delivered to your registered address.

| Usage Tips | Details |

|---|---|

Maximise Rewards | Use the card for departmental store and movie spends to earn up to 10X reward points. |

Redeem Reward Points | Convert points into vouchers or purchases via BoB Rewards portal. |

Pay Utility Bills | Use the card for electricity, mobile, and broadband bill payments to consolidate monthly expenses and earn base rewards. |

Track Spending | Monitor your transactions through the BoB Credit Card app or portal to manage usage and rewards efficiently. |

Set Up Alerts | Enable SMS and email alerts for bill due dates, spending limits, and reward milestones. |

The ASSAM RIFLES the Sentinel Credit Card is designed for users who want to maximize their credit card benefits effectively.

Disclaimer: The information provided on this page has been gathered from various reliable sources and is intended solely for general informational purposes. As details may change over time, we do not guarantee the accuracy or completeness of the content. Users are advised to verify the information with official or relevant sources before making any decisions or taking action.

Get your ASSAM RIFLES the Sentinel Credit Card in just a few simple steps